common law marriage colorado filing taxes

Pay the 25 registration fee. Filing tax returns as a married couple.

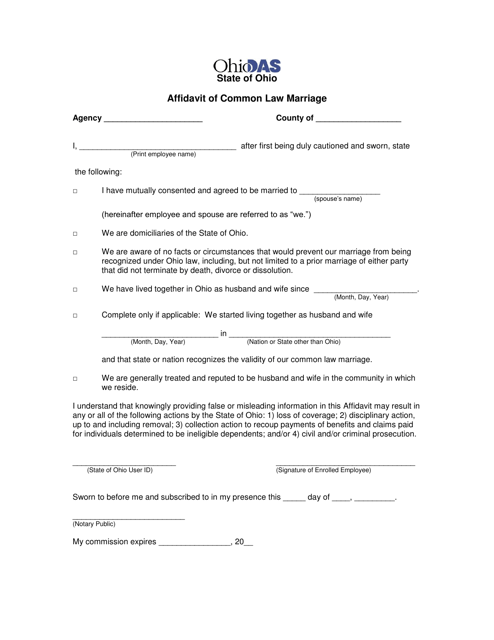

Form Adm4731 Download Fillable Pdf Or Fill Online Affidavit Of Common Law Marriage Ohio Templateroller

Apart from their personal information they need to mention the name of their common-law partner their net income and social insurance number on their tax return.

. In our present context of domestic relations remember that Colorado along with a handful of other frontier states has for many years recognized common law marriage. A common-law marriage in Colorado is valid for all purposes the same as a ceremonial marriage and it can only be terminated by death or divorce. If two people reside together as a married couple and hold themselves out.

The Court found that filing tax returns as a single person and not taking the surname of the man is sufficient basis to determine that no common law marriage exists. 14-2-1095 couples that enter into common-law marriages in Colorado from September 1 2006 have to be at least 18 years of age and satisfy other requirements such as. There is no time requirement for establishing a common law marriage in Colorado.

Taxpayers who live together in a common-law marriage recognized by the state where the marriage began. This form may be filed with a Colorado county clerk and recorders office. If you have a common-law marriage and file for divorce one of the issues for the court hearing your divorce to decide is whether the court agrees with you.

In a 1987 case People v. Common law marriages have been recognized in Colorado since the 1800s. The only major difference is that unlike a traditional divorce you may be asked to prove your marital status in front of the judges should the other party chose to deny it.

Do You Need an Affidavit of Common-Law Marriage in Colorado. That was an issue for tax filing for those couples as those common law marriages werent valid in other states. Hence the Revenue Ruling.

A common law marriage could possibly be valid after one day. Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a combined joint income tax return rather than two individual income tax returns. 102 South Tejon St.

Although marriage can potentially lead to a substantial tax penalty it can also lead to a tax bonus in other scenarios. Depending on a couples specific circumstances being husband and wife can be considered either a bonus or a penalty. Taxpayers may use the married filing jointly status if they are married and both agree to file a joint return.

If you are legally married on or before 12312015 you can choose to file one Married Filing Joint MFJ return or two Married Filing Separate MFS returns. To be considered common-law married the couple must meet all of the following criteria. Kaiser Permanente 940 P2d 1129 Colo.

Alabama Colorado District of Columbia Iowa Kansas Montana Oklahoma Pennsylvania. Parties must not be blood relatives such as siblings aunt-nephew and uncle-niece. The court does not require you to sign an affidavit of common-law marriage in Colorado.

How do you prove a common law marriage in Colorado. You would also have to run. The clerk will add your records to the database and issue two copies of a domestic partnership certificate.

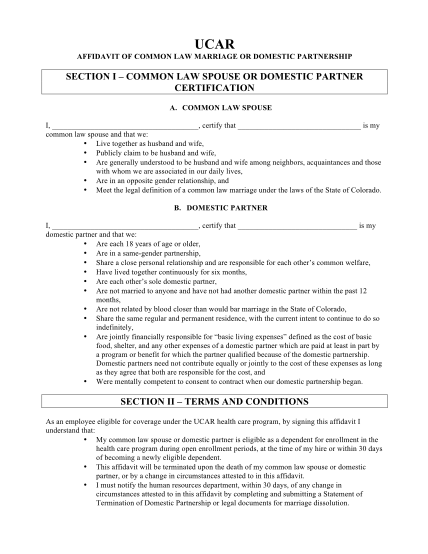

In Colorado it remains one of the indicia of common. Back to verification of marriage civil union dissolution divorce Official verification of a common-law marriage isnt available. However to reduce fraud some educational institutions or private sectors will require valid proof of your common-law union either by filling out an affidavit ie swearing that you are married or showing joint tax returns.

Lucero the Colorado Supreme Court held that common law marriage is established by the mutual consent or agreement of the parties to be husband and wife followed by a mutual and open assumption of a marital relationship The couples agreement to be. A legal common law marriage confers all the advantages and responsibilities of a formal marriage. Both are free to contract a valid.

A common-law marriage in Colorado is valid for all purposes the same as a ceremonial marriage and it can only be terminated by death or divorce. If you have a valid common-law marriage you are considered married for tax purposes. May 20 2015.

In fact Colorado is is one of very few states that permit its residents to form this type of union. The second is kept on record at the county government offices. The IRS will calculate the benefit amounts and tax credits a common law couple is eligible for.

There are numerous tax considerations for married filers. Common-law spouses may file jointly if they filed jointly on their federal tax return. 14 In Taylor v.

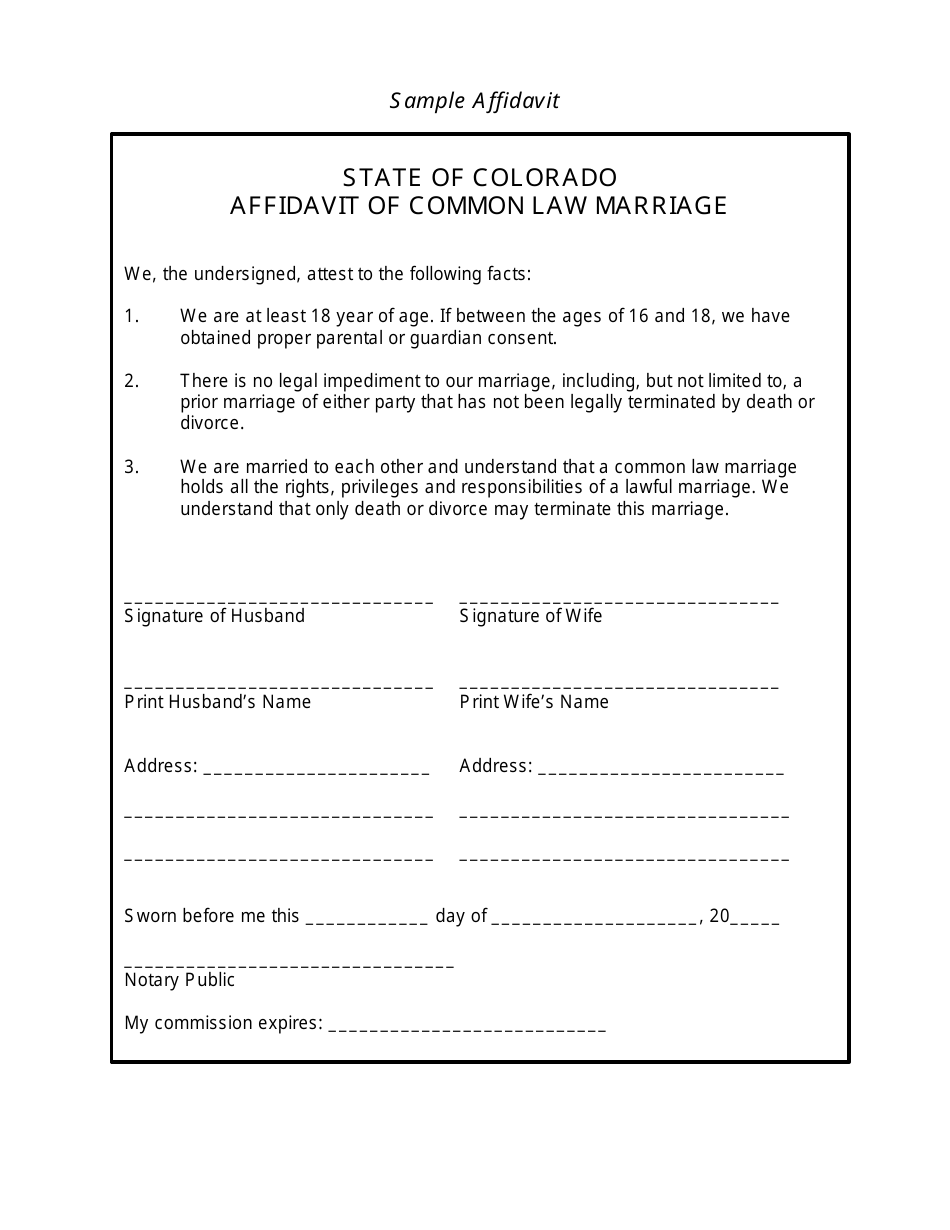

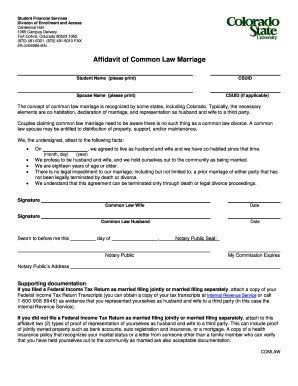

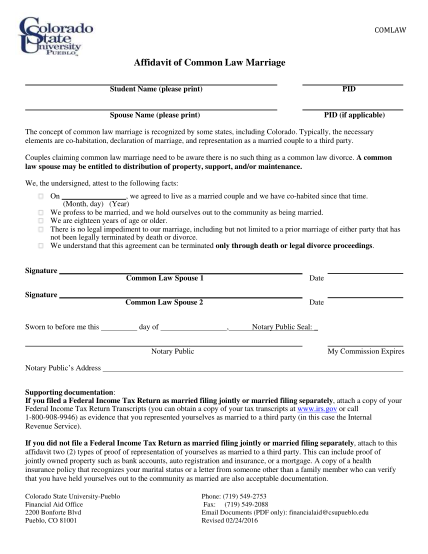

To record a marriage the parties in a common-law marriage may complete and sign an affidavit of marriage in front of a notary. Legally Married During 2018 You are considered married for tax purposes for the entire 2018 tax year if as of. Both of the common law partners must file their own tax returns with Internal Revenue Service IRS.

The two elements necessary to prove a common law marriage exists are. Common-law spouses may file jointly if they filed jointly on their federal tax return. Filing jointly has many tax benefits as the IRS and many states effectively double the width of most MFJ brackets when compared to the.

Couples who are married and who file joint tax returns have historically been able to enjoy more income before moving into a higher tax bracket and that makes sense because. Colorado is one of about ten states that recognize common law marriage. Suite 1100 Colorado Springs CO 80903.

The first copy is for you and your partner to keep. Until this year the seminal case addressing common law marriage in. Generally one MFJ return results in a lower federal tax liability.

1 mutual consent or agreement of the parties and 2 mutual and open assumption of a marital relationship You prove these elements by introducing evidence at a hearing such as witness testimony and documents. These are all the documents you need for becoming domestic partners. Courts in Colorado handle common law divorce just as they do any other dissolution of marriage.

For more than 100 years Colorado has accepted common law marriages. It can also cost as little or as much as any other type of divorce. Taylor the Colorado Court of Appeals declared that marriage is a civil contract requiring only the consent of the parties followed by cohabitation as husband and wife to be valid.

Married Filing Jointly Filing Status. To be considered common-law married the couple must meet all of the following criteria.

Colorado Common Law Marriage Colorado Family Law Guide

State Of Colorado Affidavit Of Common Law Marriage Pdfsimpli

46 Affidavit Of Common Law Marriage Colorado Free To Edit Download Print Cocodoc

Fillable Online Cu State Of Colorado Affidavit Of Common Law Marriage Cu Fax Email Print Pdffiller

Affidavit Of Common Law Marriage Colorado Free Download

Colorado Affidavit Of Common Law Marriage Pdfsimpli

Pitkin County Colorado Affidavit Of Common Law Marriage Template Download Printable Pdf Templateroller

Colorado Common Law Marriage Fill Out And Sign Printable Pdf Template Signnow

7 Printable Affidavit Of Common Law Marriage Colorado Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Colorado Common Law Marriage Colorado Family Law Guide

Affidavit Of Common Law Marriage Colorado Edit Fill Sign Online Handypdf

The Truth About Common Law Marriage Divorce In Colorado 2021

Common Law Marriage Colorado Form Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of Common Law Marriiage Kansas Edit Fill Sign Online Handypdf

What Is Common Law Marriage In Colorado Cls

46 Affidavit Of Common Law Marriage Colorado Free To Edit Download Print Cocodoc

Co Affidavit Of Common Law Marriage Complete Legal Document Online Us Legal Forms